Renters Insurance in and around Mayfield Heights

Looking for renters insurance in Mayfield Heights?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

There’s No Place Like Home

Trying to sift through savings options and coverage options on top of keeping up with friends, your pickleball league and family events, is a lot to think about and remember. But your belongings in your rented townhome may need the remarkable coverage that State Farm provides. So when trouble knocks on your door, your electronics, clothing and sound equipment have protection.

Looking for renters insurance in Mayfield Heights?

Renting a home? Insure what you own.

Safeguard Your Personal Assets

You may be unconvinced that Renters insurance can help you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the space. What it would cost to replace your possessions can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when unexpected mishaps occur.

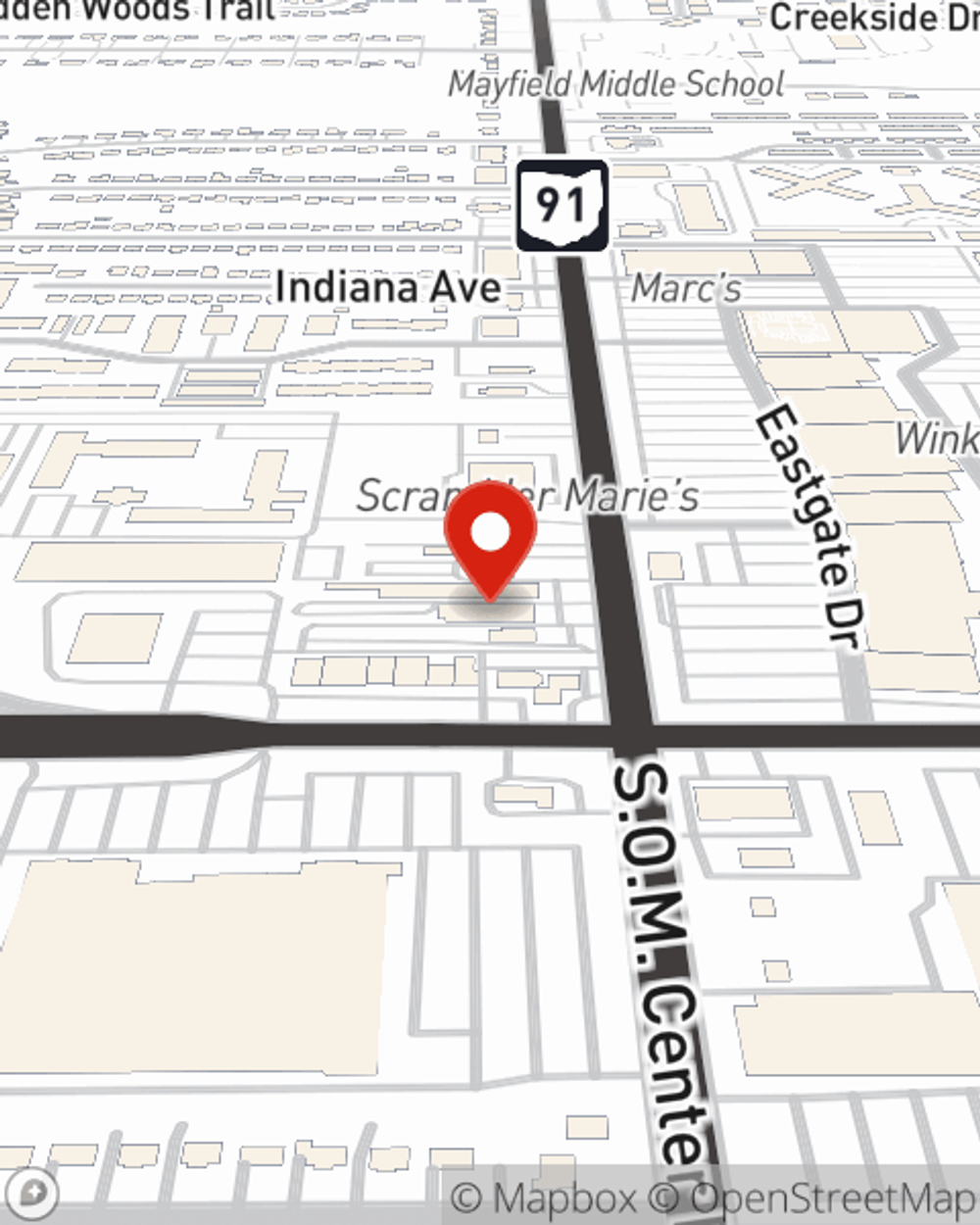

If you're looking for a value-driven provider that can help you protect your belongings and save, visit State Farm agent Dan Ritzenthaler today.

Have More Questions About Renters Insurance?

Call Dan at (440) 446-9914 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Dan Ritzenthaler

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.